Federal marginal income tax rates 2021

MARRIED FILING JOINTLY OR QUALIFYING WIDOW. Here are the rates and brackets for the 2021 tax.

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

For 2018 and previous tax years.

. Government taxes personal income on a progressive graduated scalethe more you earn the higher the percentage youll pay in taxes. 205 on the next 50195 of taxable income on the portion of taxable income over 50197 up to 100392 plus. For the 2022 tax year which you will file in 2023 single.

Updated with tax rates for tax year 2020 due April 2021 Compare the tax year 2020 tax brackets above with the federal brackets for tax year 2019 below. 0 would also be your average tax rate. 2021 Income Tax Brackets Taxes Now Due October 2022 With An Extension For the 2021 tax year there are seven federal tax brackets.

In all there are 10 official income tax brackets in California with rates ranging from as low as 1 up to 133. 10 12 22 24 32 35 and. 1 2 4 6 8 93 103 113 and 123.

HEAD OF HOUSEHOLD TAX BRACKETS. This 24 tax bracket does not mean that your. 2021 Tax Brackets by Filing Status.

California Income Tax Calculator 2021. California personal income tax rates. 15 on the first 50197 of taxable income plus.

For 2021 tax returns Sarah will pay 6749 in tax. The Federal Income Tax is a. There are seven tax brackets for most ordinary income for the 2021 tax year.

However most of the taxpayers income is taxed at a rate of 10 since most of the taxpayers income. 26 on the next 55233. California has nine tax brackets.

If you make 70000 a year living in the region of California USA you will be taxed 15111. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

This is similar to the federal income tax system. These are the federal income tax brackets for 2021 and 2022. Marginal tax rate is 12 and the taxpayers last dollar of income was taxed at that rate.

This is 0 of your total income of 0. 2021 Marginal tax rates and filing status If you are single taxpayer earning a taxable income of 100000 you would fall in the 24 tax bracket. The federal income tax consists of six marginal tax brackets ranging from a minimum of 10 to a maximum of 396.

The personal exemption for tax year 2021 remains at 0 as it was for 2020. Your tax bracket shows the rate you pay on each portion of your income for federal taxes. If you are single and your taxable income is 75000 in 2022 your marginal tax bracket is 22.

Your average tax rate is 1198 and your marginal. A permanent reduction of Colorados flat individual and corporate income tax rates changed it from 463 to. Your Federal taxes are estimated at 0.

SINGLE FILERS TAX BRACKETS.

2021 Income Taxes Digital Nomad Physicians

2022 Income Tax Brackets And The New Ideal Income

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Kentucky Income Tax Rate And Brackets 2019

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How Do Marginal Income Tax Rates Work And What If We Increased Them

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

2022 Income Tax Brackets And The New Ideal Income

How Do Marginal Income Tax Rates Work And What If We Increased Them

Income Tax Definition What Are Income Taxes How Do They Work

2022 Income Tax Brackets And The New Ideal Income

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

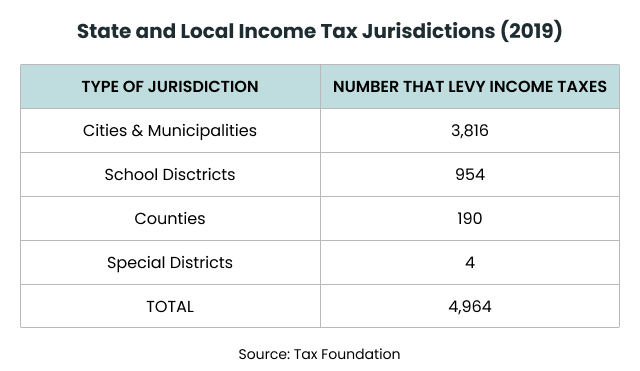

How Do State And Local Individual Income Taxes Work Tax Policy Center

Personal Income Tax Brackets Ontario 2021 Md Tax